Welcome back to Upstream Ag Insights!

This weeks index is as follows:

AgriFood Tech Investment Continues to Climb

Precision Agriculture Data Ownership May Be a Moot Point (*my favourite)

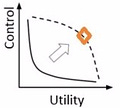

Utility vs Control Curve in Data

Agrochemical Trends in R&D

Lindsay Creates the Smart Pivot

Bayer and Blockchain Technology

Mobile Phones and Precision Technology Adoption

Moder…