Welcome to the 116th edition of Upstream Ag Insights!

Index for the week:

Deveron to Acquire Controlling Interest in A&L Canada Laboratories

Nutrien Launches Next Step Carbon Program with Sustainable Nitrogen Outcomes

Record Fertilizer Prices Drive Investors, Farmers to Microbes

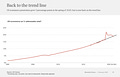

John Deere is Shifting to Recurring Revenue- What Does This Mean for Agtech?

Farm…