Upstream Ag Insights has moved. Check out the new and improved website that includes an Infographic Hub, an Audio Hub, Search, and the full archive!

Index:

Mindware: 33 Mental Models for the Modern Agribusiness Leader

2025 Crop Biostimulant Landscape

Stratus Ag Research Biostimulant Survey 2024: Insights from American Growers

The Nuance of Biostimulants

AgroSpheres and Wilbur-Ellis Launch FUN-THYME™, a Powerful Broad-Spectrum Biofungicide Built on Novel AgriCell® Technology

GDM Announces Agreement to Acquire AgReliant

Trends in agricultural technology: a review of US patents

The whys and wherefores of agtech exits: the empirical evidence

Zero to 100+ Ranches: 10 Agtech Marketing Lessons From My First Year at Lumo

Agoro Carbon Secures Flagship 12-Year Agreement to Deliver 2.6 Million Soil Carbon Removal Credits to Microsoft

Start With the Problem: A Reality Check on Product-Market Fit in AgTech

Locus of Control

Other Interesting Ag Articles (13 this week)

1. Mindware: 33 Mental Models for the Modern Agribusiness Leader - Upstream Ag Professional

Since joining the industry, one thing has stood out to me whether I have interacted with a senior executives, a marketing manager, or an agronomist— what separates the best from the rest is how they think.

Just like a carpenter has a belt full of tools, or a golfer has fourteen clubs to use depending on shot demands; high-performing agribusiness professionals need a collection of mental tools ready to be deployed for any situation they encounter.

I think of that toolset as Mindware.

This new guidebook curates 33 strategic, cognitive, and descriptive frameworks that help agribusiness professionals navigate ambiguity, anticipate second-order effects, and make sharper decisions. These concepts are grounded in real-world agricultural dynamics, and can be readily applied to precision ag or crop input strategy or when thinking about founding a business.

The linked article provides practical applications of models like the Red Queen Effect, Playing to Win, Innovation Adoption, Jobs to Be Done, Friction Reduction, Jevons Paradox, and many more— each including an overview, an illustration (where applicable), an example and practical application to agribusiness and a key takeaway for agribusiness professionals.

Whether you lead a team, are founding a business, shape strategy, or sell on the front lines, the guide is designed to strengthen your “mindware”— the internal capabilities that drive how you think and operate. In agribusiness, how you think is your competitive advantage.

Each model includes:

an overview

an application to agriculture

a key take away for agribusiness professionals

an image where applicable

This article is available to all Upstream Ag Insights subscribers and is currently in the works of being published into a digital guidebook PDF. Check out the link for full access.

2. 2025 Crop Biostimulant Landscape - The Mixing Bowl

Chris Taylor and The Mixing Bowl continue to do a fantastic job of building landscape maps for various agtech segments— this week releasing the 2025 Crop Biostimulant landscape that includes more than 350 companies:

Their landscape maps are a fantastic resource for anyone working in the ag industry.

3. ICYMI: Stratus Ag Research Biostimulant Survey 2024: Insights from American Growers - Upstream Ag Professional

Three Takeaways from the Stratus Ag Research Report and Analysis

33% of U.S. farmers used biostimulants in 2024, including seaweed extracts, amino acids, organic acids, nitrogen-fixers, and microbial products.

Satisfaction with biostimulants has remained flat over the past three years.

Nitrogen-fixing biostimulants have seen the sharpest decline in satisfaction.

Index

Biological Use Among Farmers

a. Satisfaction Not Growing

b. Expectations

Intention to Use Biostimulants Remains Much Lower Than Crop Protection

The Four E’s of Biostimulant Positioning

Distribution = King

The Nuance of Biostimulants

Final Thoughts

Biostimulant use is rising, but farmer satisfaction and repeat use intention are not as positive as they should be.

Stratus Ag Research’s latest grower survey highlights the disconnect between adoption, expectations, and farmer experience. The data uncovers what products are underperforming in perception, how retailers/retailers are (and aren’t) influencing decisions, and what needs to change to unlock sustained market growth.

From nitrogen-fixing frustrations to the role of distribution, and why treating biologicals like seed alone isn’t the right approach, there’s nuance that every individual working in the segment should consider.

For the full breakdown, including exclusive Stratus images and survey data, context and implications for the wider biological segment, become an Upstream Ag Professional member today:

4. The Nuance of Biostimulants - Upstream Ag Professional

I expanded on biostimulant positioning, emphasizing the biostimulant nuance compared to other crop input segments.

Here are some key takeaways from the full updated article available at the link in the heading:

Despite growth, biostimulants remain poorly understood across the value chain— by farmers, by retailers and by manufacturers.

They don’t fit traditional input models: Biostimulants share traits with seed, crop protection, and inoculants, but none of those frameworks alone are sufficient for success in the segment— consultative selling like seed, function specific messaging like crop protection and supply chain and application considerations are needed like inoculants.

For the full breakdown looking at how to improve positioning and uptake of biostimulants, become an Upstream Ag Professional member:

5. AgroSpheres and Wilbur-Ellis Launch FUN-THYME™, a Powerful Broad-Spectrum Biofungicide Built on Novel AgriCell® Technology - Business Wire

AgroSpheres, a biotechnology company transforming crop protection with biobased innovations, today announced the commercial launch of FUN-THYME™, a groundbreaking, broad-spectrum biofungicide derived from thyme oil and delivered through the company’s proprietary AgriCell encapsulation platform. Through an exclusive distribution agreement, Wilbur-Ellis will introduce FUN-THYME™ to growers across the United States, helping them protect high-value crops including almonds, apples, tomatoes, cherries, berries and grapes. This pioneering product offers a new level of pest management efficiency and a highly effective alternative to traditional chemistries for both conventional and organic farming systems.

Wilbur Ellis’s CVC Cavallo Ventures is an investor in AgroSpheres.

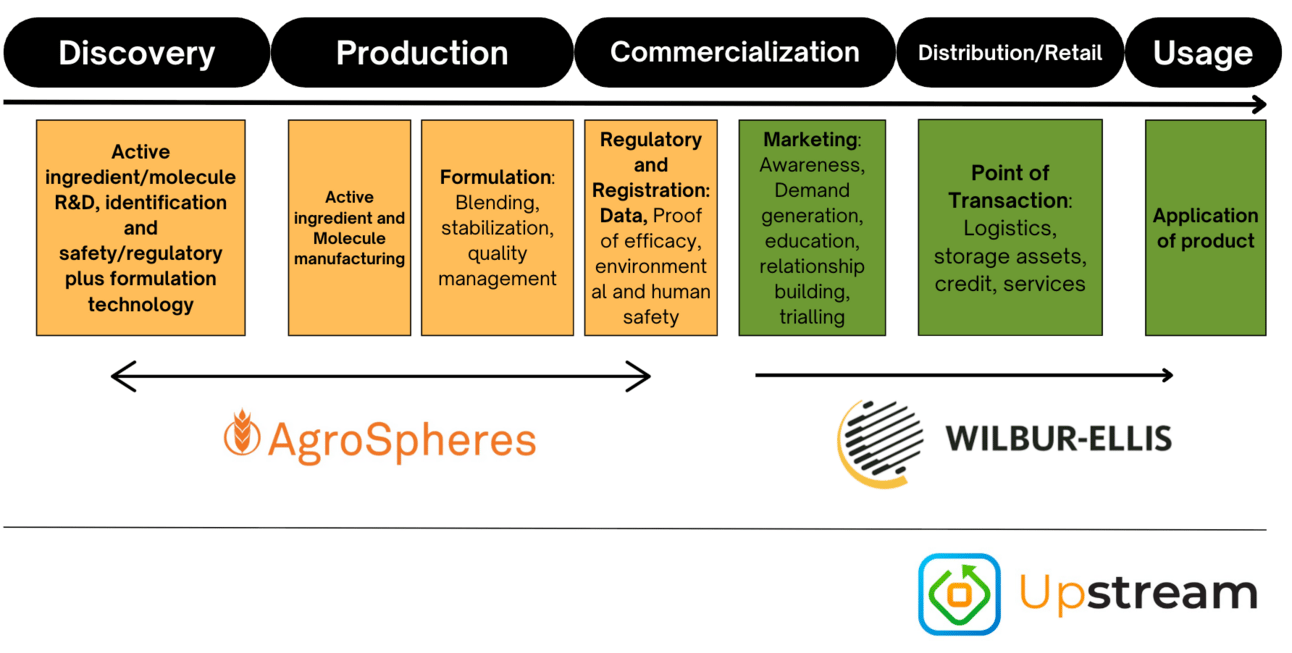

Last year, when highlighting AgroSpheres and their technology I emphasized the potential to collapse the value chain and leverage the Wilbur Ellis retail market access:

AgroSpheres is a strategic investment — Wilbur Ellis could make up the marketing, point of transaction and application components required through its own proprietary product, offering AgroSpheres technology a potential route to market and a novel technology for Wilbur Ellis to offer customers.

That’s exactly what this product announcement is leveraging, which benefits both players, so I think it’s a smart move for both groups.

How Wilbur Ellis flexes it’s demand generation capabilities will be interesting to watch— many retailers rely on the demand generation from the large manufacturers like Bayer and Corteva and then simply harvest that demand at the field level, but this will require a more significant marketing and training investment.

I do think we will see more of these alignments — savvy retailers are looking for ways to build out their proprietary product portfolio’s and agtech start-ups are looking for market access.

6. GDM Announces Agreement to Acquire AgReliant - GDM

GDM, a global plant genetics company committed to empowering farmers and advancing global agriculture, today announced an agreement to acquire 100% of the shares in AgReliant Genetics, a leading North American provider of corn and soybean seeds. The strategic acquisition brings together GDM’s global scale, long-time reputation for world-class innovation and elite soybean genetics expertise with AgReliant’s market leadership in corn breeding and genetics, strengthening GDM’s portfolio of high-performing seed solutions for growers and underscoring its commitment to growth in the region.

GDM has rapidly expanded through strategic acquisitions. GDM is best known for its dominance in soybean genetics. Their germplasm is used in over 40% of global soybean production. In South America, it became a top-three soybean seed provider in Brazil and acquired KWS’s corn and sorghum assets, securing roughly 10% of the Brazilian corn seed market.

In North America, GDM entered the U.S. and Canadian markets by acquiring Local Seed Company in 2021 and rebranding W.S. Seeds as Mustang Seeds in 2022, broadening its footprint in soy, wheat, and corn.

AgReliant Genetics was a joint venture between KWS and Limagrain. This acquisition represents a significant step in GDM’s push into corn genetics. By taking over AgReliant’s assets, GDM elevates its position in the North American corn market and is now one of the top four global providers of proprietary corn genetics after Corteva, Bayer, and Syngenta.

7. Trends in Agricultural Technology: A Review of US Patents - Springer

This is a really interesting review of ag related patent data.

The full paper is worth reading for those interested.

Notable Takeaways

32,365 U.S. ag patents (2014–2024) were analyzed— over 52% were in Biotech & Bioengineering, followed by 36% in Manufacturing Technologies & Equipment.

Biotech and Equipment patent growth is plateauing, while Automation, Control & Robotics grew +213%. A significant rise, not surprising considering the interest in this segment.

For the full key takeaways, plus access to the 2025 Upstream Ag Professional patent analysis segments, become a member today:

Crop Protection Company Patent Analysis: Formulation Technology and Fighting Generics - Upstream Ag Professional

Five Technology Patents from John Deere and What They Might Mean for the Future of Precision Agriculture - Upstream Ag Professional

8. The whys and wherefores of agtech exits: the empirical evidence - AgTech Navigator

In May, Managing Director at Syngenta Ventures Michael Lee, shared a statement saying “On the best data I can get, m&a values are 10-times higher when the corn price is above $7 a bushel.”

This week he shared some more data to support, including the below table:

Source: Michael Lee, AgTech Navigator article “The whys and wherefores of agtech exits: the empirical evidence”

What his work highlights is that capital efficiency remains crucial for startups—especially those aiming for acquisition by OEMs or major ag incumbents, like talked about on this edition of AgTech So What?

Lee suggests that total capital raised should stay below $50 million, ideally split between $15 million across early rounds and no more than $35 million in the final round. Exceeding those thresholds can lead to misalignment between capital invested and likely exit value.

The average exit value among the top 10 agtech transactions sits at roughly $400 million which means investors and agtech companies should set expectations accordingly for exits.

Other Interesting Takeaways:

Meristem was acquired by PE firm Bridgepoint in 2024, with the number not publicly shared, however the data above states that the price Bridgepoint paid for Meristem was $400 million.

In that same vein, BW Fusion was stated as acquired for $280 million by Bain.

Bio-company Intrinsyx was acquired by Syngenta earlier this year at an undisclosed price, however the data shared states that the price paid was $79 million— which shows I was wrong on the presumptive price paid for Intrinsyx. I suggested the acquisition price was likely “low,” being <$25 million. The price suggests there is still an appetite from major crop protection companies for access to novel bio-based products.

9. Zero to 100+ Ranches: 10 Agtech Marketing Lessons From My First Year at Lumo - Steele Roddick Linkedin

This is a great list of learnings from Steele Roddick at Lumo Ag.

One that he highlighted that I think is under emphasized is #3, Driving density matters most:

In agtech, you want as many customers in as tight of a geographic area as possible. At Lumo, we focused on vineyards in Napa and Sonoma to start.

There are two reasons density is so important: word-of-mouth and in-field support.

Growers buy from growers. They want to see your product working in the field, ideally at a ranch that’s run by someone they already know and trust. They want to hear what they have to say, how the experience has been, where they’re seeing ROI. The more customers you’re able to win over in one area, the easier it will be to host field events, and the faster the word will spread.

While not a rule, I view most geographic expansion as a negative signal for agtech companies— most have not saturated their core market where they have the best chance of success, yet begin expanding regions and burning resources.

Check out the full article for his other takeaways.

Related: Four Business Building Takeaways Everyone Can Learn from Lumo Ag - Upstream Ag Professional

10. Agoro Carbon Secures Flagship 12-Year Agreement to Deliver 2.6 Million Soil Carbon Removal Credits to Microsoft - Business Wire

Agoro Carbon signed a landmark 12-year off take agreement to deliver 2.6 million carbon removal credits to Microsoft.

This agreement represents one of the largest soil-based carbon removals commitments to date, marking a significant milestone in the advancement of agriculture-driven climate solutions. It unlocks significant investment to scale sustainable agriculture, reflecting corporate demand for durable, science-backed soil carbon removals.

Highlights

2.6 million carbon credits over 12 years equates to 216,000 credits per year.

The credits will come from U.S.-based crop and rangeland projects under Verra’s VM0042 methodology and undergo third-party verification, field-level soil sampling, and advanced modeling to meet durability and transparency standards.

No price commitment was stated for the credits.

From the Microsoft Sustainability Report: “In FY24, we contracted nearly 22 million metric tons of carbon removals to be delivered at various points over the next 15+ years. This includes 2.8 million metric tons that we expect to be delivered in our FY30 goal year for carbon negativity and many more tons toward carbon negativity for FY31 and beyond.” For context, if Microsoft expects to offset 2.8 million tonnes per year by 2030, that would suggest that Agoro credits would make up ~7.5% of Microsofts total annual offsets.

11. Start With the Problem: A Reality Check on Product-Market Fit in AgTech - Patrick Honcoop

Patrick Honcoop wrote a nice article on a topic that frequently comes up in the industry. It’s one I have thought a lot about and he captures well.

I wrote on a similar thread in February 2021, highlighting an article by AgFunder’s Rob Leclerc titled VC Mental Models: Is your product a vitamin, pain killer, narcotic, or a religion? which provides a useful framework for thinking about valuable products and companies.

I shared the basic framework I used for thinking about problems and product market fit:

Assess the intensity of the problem

Identify the frequency of the problem

Assess the willingness to pay to alleviate the problem

Assess the addressable market that has the problem

Not only is every problem not worth paying for, but not every problem has a solution that can create an enduring business.

Over the last 4 years what I have found other questions that need to be asked on top.

For full access to the other crucial considerations, become an Upstream Ag Professional member today:

Non Ag Article

Locus of Control - The One Percent Rule

This article explores the impact of attitude— not intelligence, talent, or circumstance as the key determinant of success and resilience. It argues that attitude is rooted in our locus of control and reinforced by cognitive habits like reframing and persistence.

Other Interesting Ag Articles

2025 THRIVE Top 50 AgTech Report - THRIVE

Crop Fertility and Humics M&A - The Pacesetter Pod

Drones Help Soybean Grower Hit the Bull’s Eye of Efficiency - AgWeb

AgTech Reality Check: AI, ML & LLMs - INTENT

ExactRate vs ExactShot: John Deere Fertilizer Systems Explained - YouTube

It's time to kill AgriFoodTech as an investment category - Walt Duflock

Lindsay Q3 2025 Results - Lindsay

After Farmwise, it's Naïo's turn to have financial difficulties - AgTech Market

Consolidation in Agribusiness: Lessons from a Storm and the Future of Crop Input Distribution in Brazil - AgroPages

Conduit Ag and Future Farm Partner - Linkedin

Declining Yield Variability and 2025 US Corn and Soybean Yield Distribution - FarmDoc Daily

BASF introduces InVigor Gold, a breakthrough innovation in canola seed - SeedQuest

ScanIt and Kelly Hills Collaborate - Linkedin