Upstream Ag Insights - July 12th

Essential news and analysis for agribusiness leaders for the week of July 12th

I hope everyone is having a great weekend! Welcome to all the new subscribers from the past week. Thank you to all of you who have shared Upstream with your friends and colleagues of late!

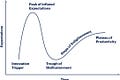

AgTech Hasn’t Expanded Markets like Consumer Tech Has

One thing I’ve been thinking about lately is why agtech hasn’t seen sizable exits or IPO’s. Having had conversatio…