Welcome to the 155th Edition of Upstream Ag Insights!

Q4 2022 agribusiness results have started to be released so next week I will aim to have a summary. 2022 10-K’s have also began to be released and 2022 Annual Reports will be out soon so expect write-up’s on those areas in the coming weeks and months.

Index for the week:

Progressive Productivity in Agriculture Production

Beyond Black and White in Ag

Hung Up on ESG And Your Value Proposition: You Don't Have To Be A Leader, Be A Fast Follower

John Deere Offers HarvestLab 3000 Grain Sensing for Combines

Farm Management Software Follow Up

Agtech: Breaking Down the Farmer Adoption Dilemma

Trimble's Precision Ag Products Now Available From Independent Dealer Partners For All Makes and Models

Q4 2022 Agtech Report

We Only Deserve a Styrofoam Cup

Thanks for reading, sharing and subscribing!

1. Progressive Productivity in Agriculture Production - Simon Maechling Linkedin

This past week I read the above post on Linkedin from Simon Maechling who works with Bayer.

Simon posted what I think is a great visual that Bayer has referenced before in their investor materials. It does a great job illustrating how the agriculture industry has been able to increase production capacity.

However, many commenters did not see it in a positive way. One commenter stated the following:

Jean brings up a valid point - there are externalities. There are algal blooms from phosphorous run off to challenges with pesticide drift and a reduction in organic matter and overall soil health thanks to tillage (plus more). Increasing productivity over the years to supply products to a growing global population has been the most important emphasis. It’s notable though that a lot of other technological progress stands on the shoulders of agricultural innovation; these increased production abilities have been a catalyst for the division of labour delivering us many of the luxuries we have now (like the screen you are reading this on). In 1850 farming made up 3 in 5 U.S. jobs. By 1970 that number was less than 1 in 20. Today it is less than 2 in 100.

The world is full of trade offs. I don’t mean that in the sense that we should accept these externalities in their entirety - there is an obligation for the industry to minimize externalities. However, it’s easy to point the finger at the in-your-face, measurable challenges like GHG emissions from the Haber-Bosch method because they are more tangible. What is less in the face of people are stats like this from Our World in Data around what would have been:

Without the Haber-Bosch method we would have experienced much more starvation and malnutrition than we see today.

It’s also easy to say “annually grown monocultures are bad” (extrapolating Jean’s “loss of biodiversity” comment here). I think many in the industry acknowledge the benefits to intercropping and reducing tillage. The important part to remember and acknowledge is that we got to where we are with monocultures because of the need to initially produce more along with the need for scale and efficiency on farms plus a lack of technology to seamlessly do intercrop harvesting, sorting or storage etc. One could even fault groups like the US government to some degree for how they decided to subsidize corn or grain commodity companies who also emphasized efficiency and scale. Only in the last couple of decades have we seen engineering and technology make it easier to integrate on the farm, but the ag ecosystem is structured in a way still that makes it difficult to readily adopt many other practices. There is not only technology needed, but human knowledge to support production practice shifts.

I mentioned the obligation for improvement agriculture has. While it’s always possible to do more, the numbers below illustrate a directional arrow of progress.

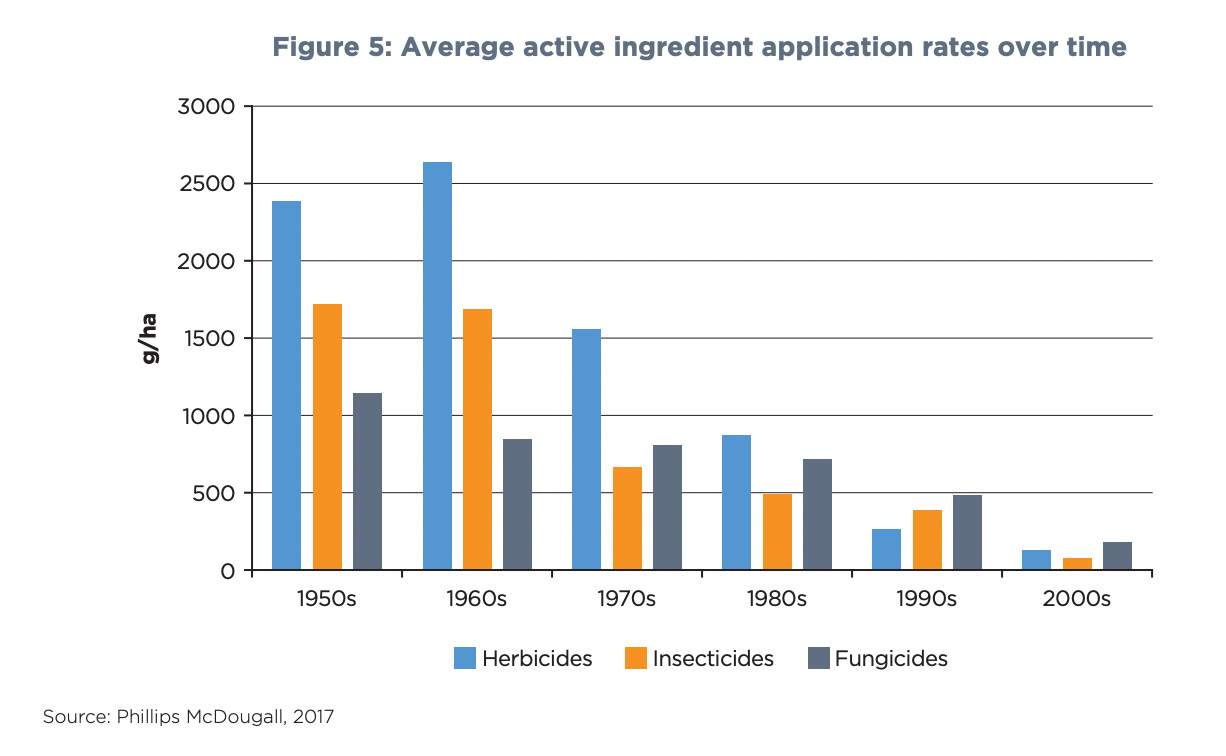

I think frequently of this data from Phillips McDougall that is good context on the progress that has been made surrounding crop protection products:

Average application rates in the 1950s were 1,200, 1,700, and 2,400 grams of active ingredient used per hectare for fungicides, insecticides, and herbicides respectively. By the 2000s the average use rates were reduced to 100, 40, and 75 g/ha.

The decline is palpable (Note: I acknowledge the picture is incomplete because my assumption is this chart doesn’t consider total treated area, meaning less acres got treated in the 1950’s where as today EVERY acre gets treated leading to a higher total utilization of active ingredient when summed, just less on a per acre basis).

In the 1950’s the average corn yield per acre was below 60bu/ac. Rounding to 60 that means 148bu/hectare equating to:

8 grams of fungicide per bushel of corn

11.5 grams of insecticides per bushel of corn

16 grams of herbicide per bushel of corn

(Note: using corn as the default standard, it will vary by crop)

Using the 2021 corn average of 175bu/ac equates to 432 bu/hectare meaning there was:

0.23 grams of fungicide used per bushel of corn

0.09 grams of insecticide used per bushel of corn

0.17 grams of herbicide used per bushel of corn

Yields have nearly tripled on average, while crop protection usage as grams per hectare have reduced by 95% and grams per bushel have declined by >98%!

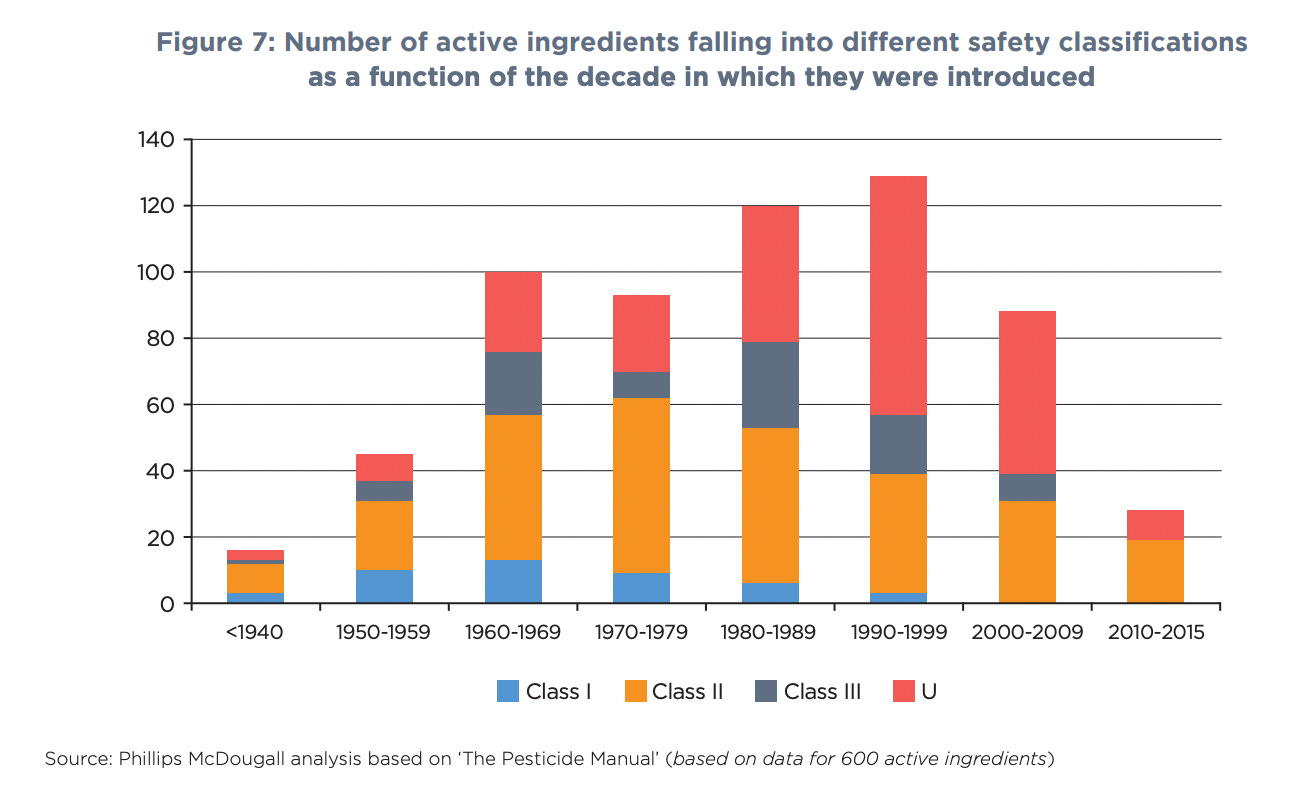

Not to mention, the relative safety of the active ingredients used has improved as well:

It should be noted, the metric for safety in this case is LD50 in humans and not explicitly environmental impact, but there is a quote emphasizing environmental improvements as well:

New and better pesticide active ingredients (more effective and less harmful to human health and the environment) have frequently been introduced while other active ingredients have been banned or voluntarily canceled by their manufacturers.

There will always be room to improve when it comes to environmental safety and crop protection products, but the improvements over the last ~60 years are impressive.

There is reason to be optimistic that usage will continue to decrease with precision agriculture adoption (such as smart spraying) and moves towards alternative ingredients to manage pests.

There is still more to the story that I do not have the answer to; I do not have nitrogen or phosphorous usage rate charts included, which are likely to have gone up along with organic matter reduction in many areas for example. I think ultimately this illustrates the complexity and nuance and both sides of the discussion will always struggle to paint the entire picture.

In my mind it opens the door to build on that image and illustrate carbon foot print by inputs per bushel, nitrogen use efficiency and other metrics to reinforce the incremental progress that has came from technology in agriculture.

Progress comes with trade offs. Im optimistic that we will continue to see the externalities of this progression improve.

2. Beyond Black and White in Ag - Tenacious Ventures

My friend Sarah Nolet nails her write-up in an area I frequently think about: black and white thinking and it’s impact on the ag industry.

In Thinking in Grey and in 22 Mental Hacks for Agribusiness Leaders, I state the following:

We need to stop thinking in black and white. The world is grey.

Two great business thinkers have concepts surrounding this logic, which highlights the importance of overcoming black and white thinking.

Jim Collins in Built to Last talks about “The Tyranny of the Or” vs. “The Greatness of the And”. In short, his concept is that when we consider a decision and position it as an “or” proposition (we must choose A or B), we are confining ourselves to only one of two choices – and they are usually at opposite ends of the spectrum. Black or white. Yes or no. Right or wrong. When we substitute “and” in place of “or” we open up our range of choices or solutions to an infinite number of options that are between A and B. And in most instances, there is a sweet spot in the middle that does a pretty good job of meeting the needs on both sides, delivering a superior outcome.

In The Opposable Mind Roger Martin proposes integrative thinking as the thinking process for innovation and success. This approach is a discipline of considering two opposing ideas at the same time and producing a synthesis, or a new idea altogether, that is superior to both. Martin states this as “the ability to face constructively the tension of opposing ideas and, instead of choosing one at the expense of the other, generate a creative resolution of the tension in the form of a new idea that contains elements of the opposing ideas but is superior to both”.