Welcome to the 113th Edition of Upstream Ag Insights!

Index for the week:

Nutrien 2021 Annual Report Highlights and Analysis

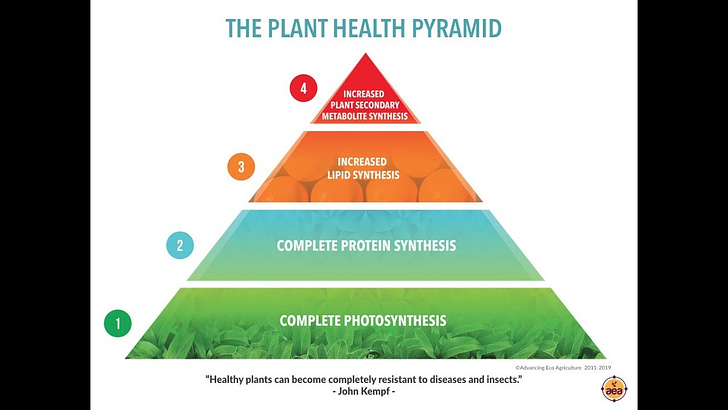

Ag Retails Biggest Mistake Today

SVG Ventures|THRIVE & Koch Agronomic Services join Forces to Identify Open Innovation Opportunities

Planet Launches Planetary Variables

Tokenisation of Agriculture

John Kempf’s innovation-forward regenera…