UPL 2020 Annual Report Highlights and Analysis

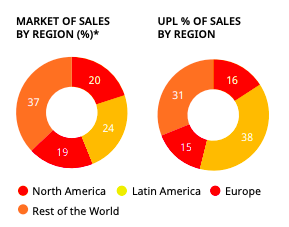

UPL is an India based organization that, at least in North America, does not receive a ton of attention. Part of the reason is their business is not as large in North America:

Only about 15% of their business is in North America. Europe is also only around 15% of their business, meaning 70% of their business is in Asia, Australia, Latin America and Afric…